In 1918, the financial landscape was forever altered with the introduction of the first electronic fund transfer. This marked the beginning of an era where financial institutions began to evolve hand-in-hand with the burgeoning fields of communication and the internet. This union of technology and finance promised enhanced efficiency, reach, and security.

Fast forward to the early 1970s, the financial world reached another significant milestone with the establishment of the first international digital stock. Alongside this, the global finance sector witnessed the birth of the SWIFT payment protocol, a groundbreaking electronic cross-country payment system. This not only revolutionized the speed and efficiency of global transactions but also underscored the importance of safe and secure communication channels in finance.

The 1990s represented a transformative period. Computers, which had previously been exclusive to tech aficionados and large corporations, were becoming household staples. This widespread accessibility ushered in the age of online banking, allowing users to handle their finances from the comfort of their homes. Transactions, balance checks, and other banking operations were now just a click away.

However, the true watershed moment came in 2009 with the introduction of blockchain technology. This decentralized and immutable ledger system challenged traditional notions of banking and financial trust. Blockchain’s introduction prompted consumers to rethink their relationship with banks and paved the way for decentralized finance.

Today’s banking environment is highly dynamic. Tech conglomerates are making significant inroads into the financial sector, giving birth to a myriad of financial startups. These startups, underpinned by cutting-edge technology, promise users an unprecedented level of security and autonomy over their finances.

Amidst these disruptions, traditional banks and financial institutions find themselves at a crossroads. They face the dual challenge of enhancing operational efficiency and retaining their customer base, all while keeping overheads low. This conundrum led to the emergence of Robotic Process Automation (RPA) in the banking sector. RPA represents the fusion of technology and banking operations. One notable example is AI-driven chatbots. These virtual assistants can seamlessly execute a wide variety of banking functions, liberating skilled professionals to dedicate their time to more complex, value-added tasks and projects.

Given this technological shift, Fintech development companies with a rich legacy of expertise and successful projects are poised to lead the charge in banking digitization. They have taken the mantle of automating mundane tasks, enabling banks to recalibrate their focus towards strategy, innovation, and most crucially, enhancing customer experience.

To provide further insights, let’s take a closer look at 10 standout banking software development companies. These firms are distinguished not only by their avant-garde technological solutions and impressive track records but also by their commitment to delivering top-tier software development at an affordable price point

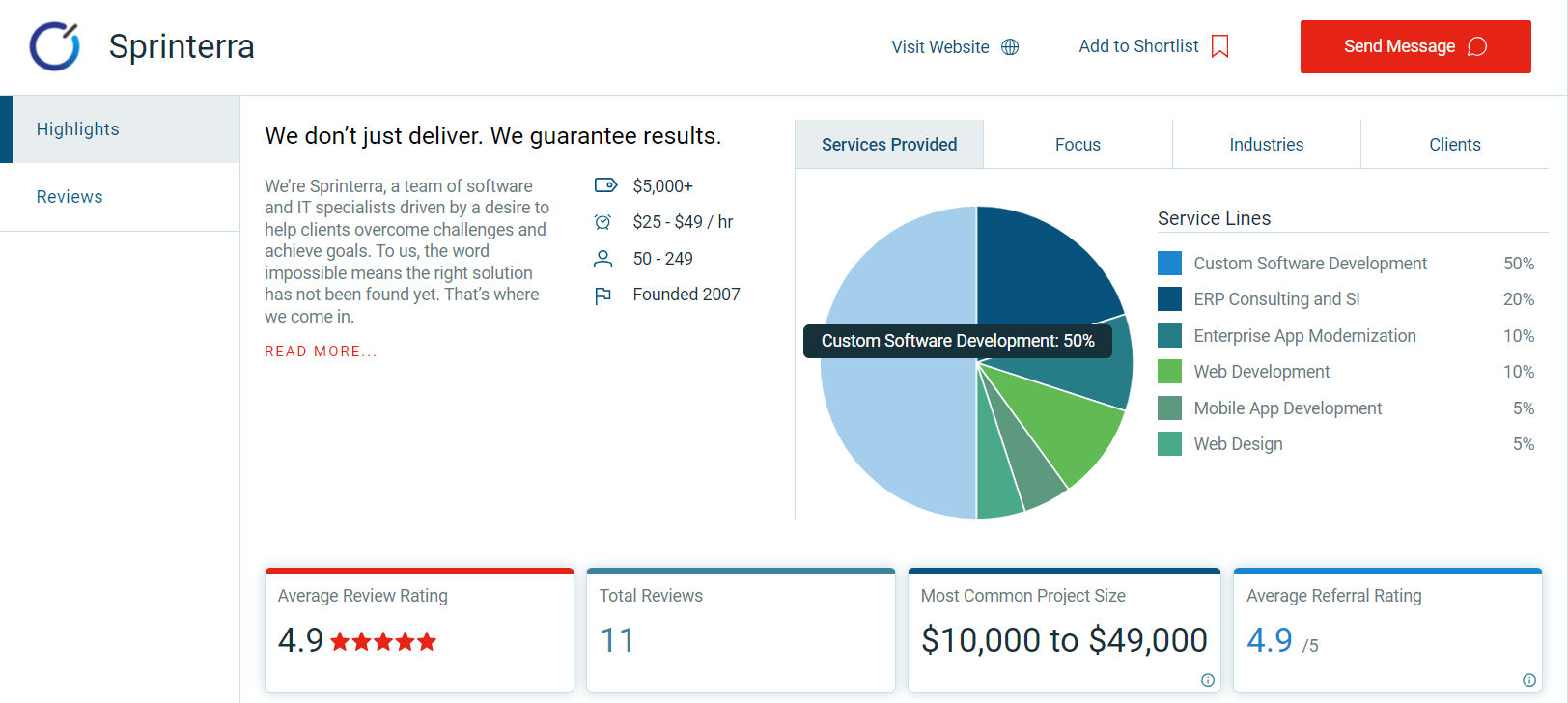

The Digital Vanguard: Sprinterra

In the digital age, mere adaptability is no longer sufficient; what banks need is a transformative leap. Sprinterra is at the forefront of such a revolution, offering more than just digitization – it promises a total metamorphosis in how banks operate and flourish.

In our contemporary, fast-paced world, adopting digital processes isn’t just a strategic advantage; it’s imperative.

Unlocking New Dimensions with Sprinterra:

The Sprinterra Promise:

Whether you’re on the cusp of your digital journey or seeking to elevate your existing digital strategies, Sprinterra’s bespoke solutions ensure that your unique vision is realized in its entirety.

Tailored Solutions for Modern Banking:

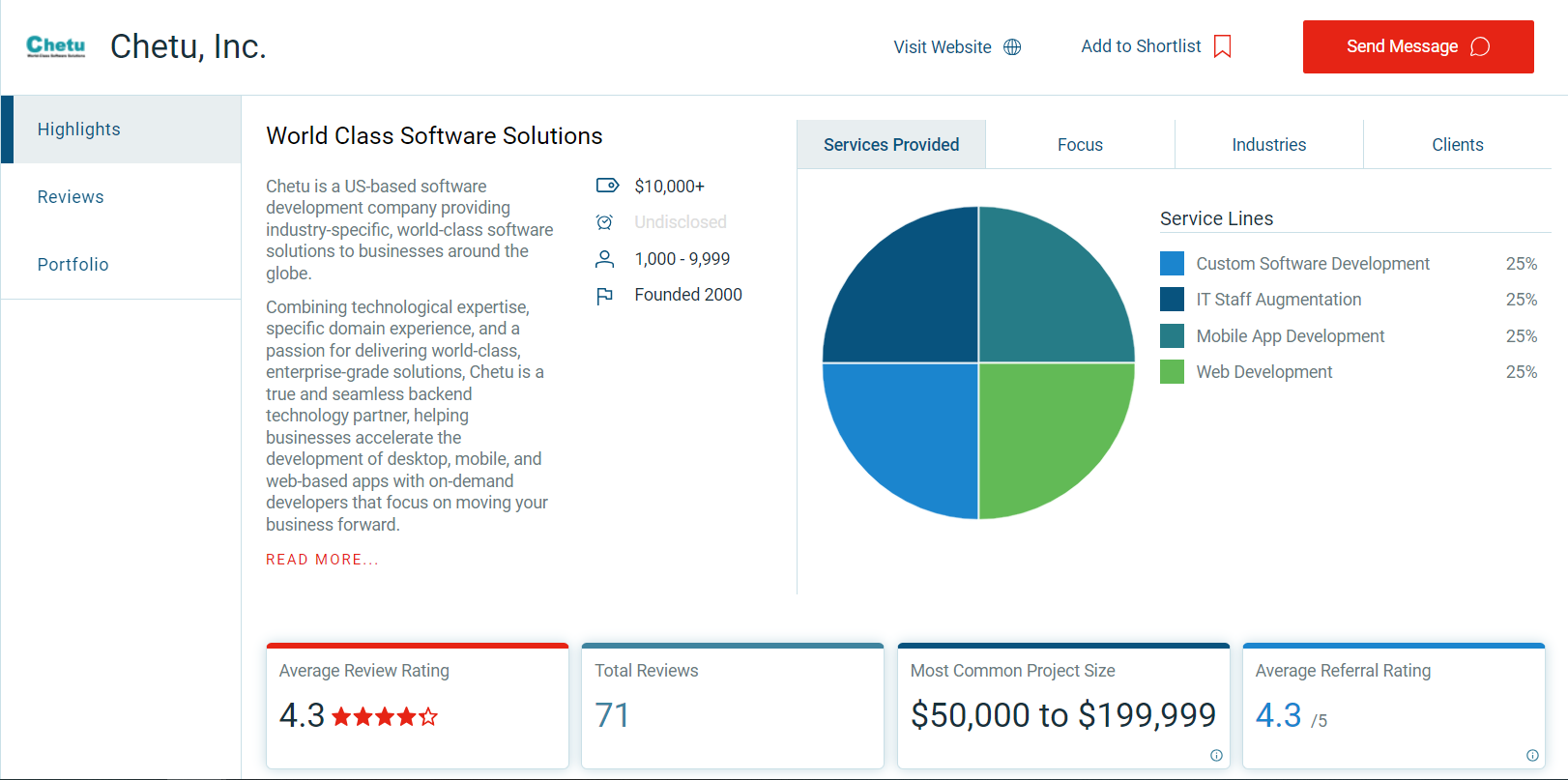

Chetu stands at the technological forefront, offering avant-garde software solutions tailored to the dynamic banking industry. With a team of proficient developers, Chetu aims to metamorphose the foundational infrastructure of banking, ensuring a seamless and efficient financial workflow.

Core Offerings:

Innovation with AI-Driven Solutions:

Chetu’s mastery lies in the art of leveraging Artificial Intelligence (AI) to sculpt transformative solutions:

At the crux, Chetu is not just offering software solutions; it’s sculpting the future of banking, empowering financial institutions to navigate the digital age with confidence and agility.

Embracing the Digital Shift in Banking:

The landscape of banking has dramatically shifted from the days of yesteryear. Gone are the moments when clients solely relied on physical bank branches for solutions. The modern client’s preferences are deeply rooted in digital realms, with online platforms being their go-to avenue for solving financial issues. This swift transition demands the banking system to constantly innovate and adapt. For a financial institution to thrive and stay relevant in today’s age, several key innovations are imperative:

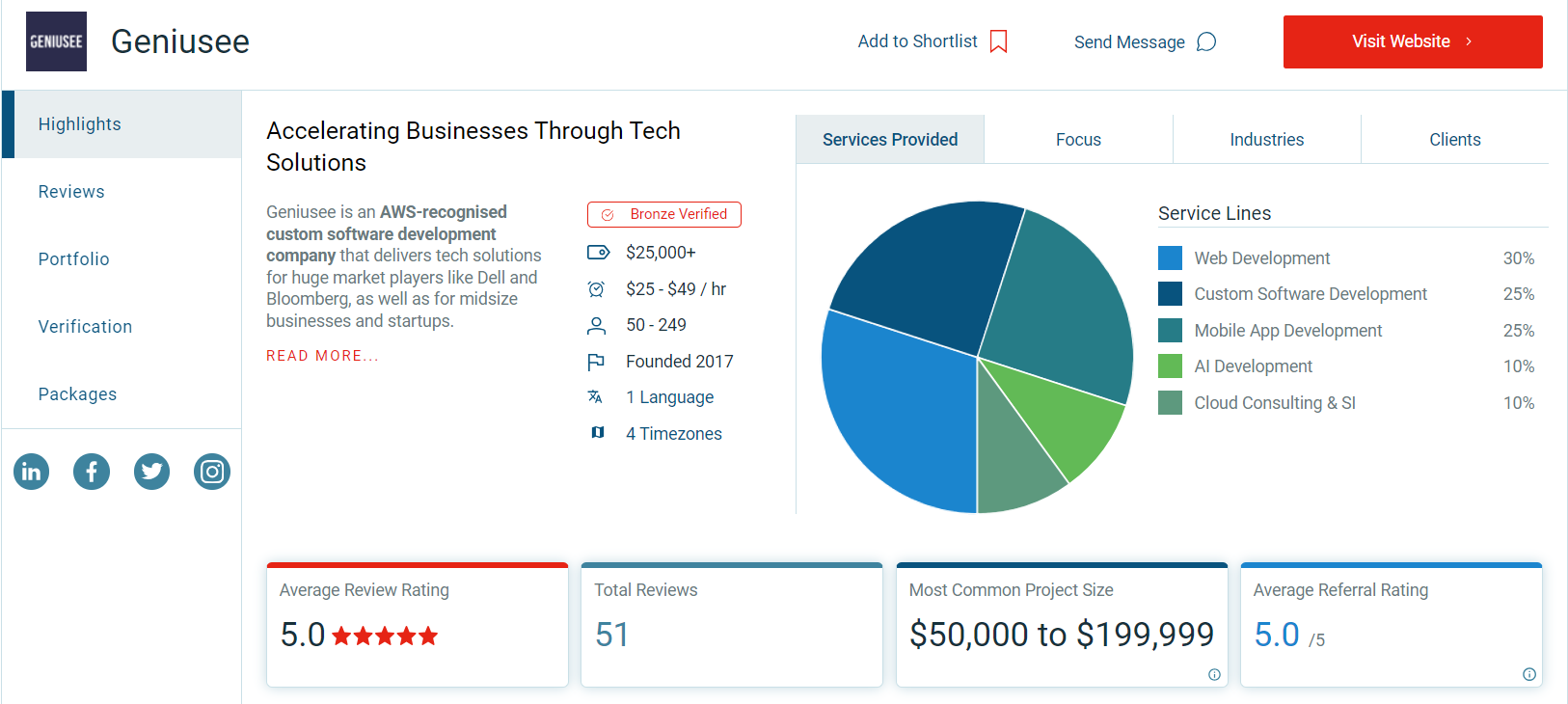

The Geniusee Approach: Expertise Meets Innovation

The challenges of the digital era are vast, encompassing issues related to data storage, transfer, and security. Addressing these challenges demands not just solutions, but the right ones—crafted with expertise and precision. That’s where Geniusee’s prowess in banking software development solutions comes into play.

With a rich reservoir of experience and a suite of skills tailored for the modern banking world, Geniusee understands the nuances of the industry. They are adept at offering solutions that don’t just tick boxes but set standards, ensuring that financial institutions are not just participants in the digital revolution but leaders.

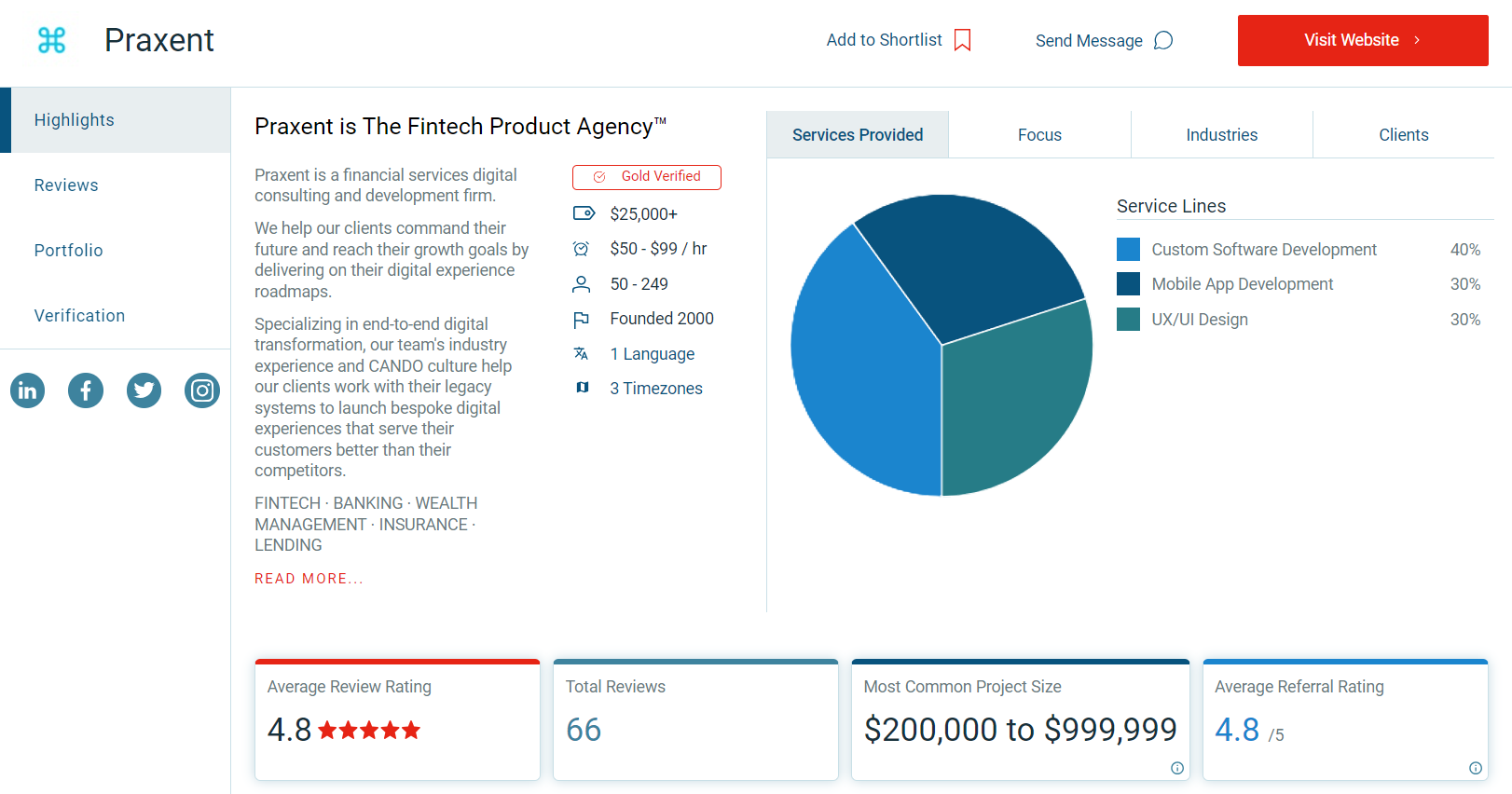

With two decades of deep-rooted experience in banking and FinTech, Praxtent stands as an emblem of innovation in software development.

Boasting a robust team of over 70 proficient software designers and developers, Praxtent has always placed its customers at the heart of its mission. They seamlessly intertwine UX design research, agile software development, rigorous testing, and user validation to deliver state-of-the-art software solutions that resonate with end-users.

Garnering recognition from Inc 5000, Praxtent’s steadfast commitment to excellence has carved its name as one of the industry’s elite financial software providers.

Praxtent is not just about building software; it’s about enhancing operations without disrupting daily workflows. With a forward-looking approach to product design and innovation, Praxtent ensures businesses stay relevant and agile in a dynamically evolving market landscape. From front-end redesigns to seamless cloud migrations, they’ve got it covered.

The hallmark of Praxtent’s success lies in its collaborative ethos. Clients are not just passive recipients but active participants throughout a project’s lifecycle, which typically jumpstarts in as little as two weeks from its inception. This collaboration ensures timely, bespoke solutions that allow businesses to modernize without missing a beat.

Navigating sectors like insurance, investments, financial advisement, and automated services, Praxtent’s vast experience in FinTech and banking is undeniable. Their illustrious portfolio includes collaborations with esteemed names like OpenLending, Austin Capital Bank, Sage Equity Partners, BlueStar Retirement, Synctera, Meriwest Credit Union, Dimensional Fund Advisers, Neocova, Integris Group, and MX.

Services Offered by Praxtent:

Financial commitment:

In a nutshell, Praxtent emerges as a powerhouse of experience, adaptability, and innovation in the ever-evolving world of fintech and banking software solutions.

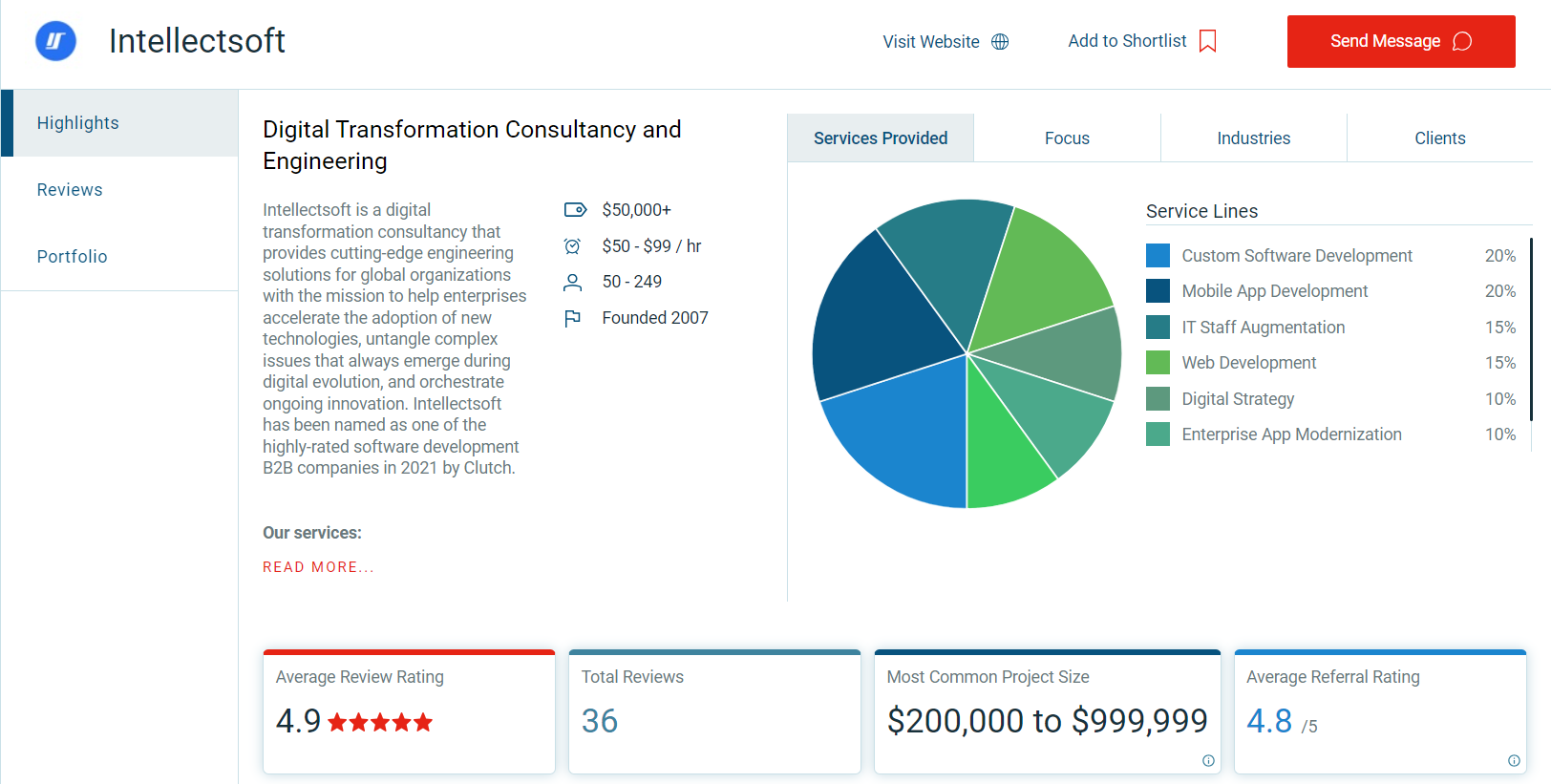

Standing tall amongst the leaders in software development for banking and fintech sectors, Intellectsoft emerges as an emblematic name, recognized for sculpting avant-garde digital solutions that have catalyzed transformations globally.

Intellectsoft’s prowess lies in its agile approach to addressing intricate challenges, effectively accelerating the transition to groundbreaking technologies. With an exemplary portfolio underscoring their dedication to customers, strategic vision, user-centric design, and expansive service offerings, they have etched their position as a trusted ally for financial institutions aiming to resonate with the pulse of the digital age.

A partnership with Intellectsoft ensures a bespoke developmental journey tailored to the intricacies of individual needs. They incorporate a strategic blend of tech integration, system upgrades, and efficient system implementation, among other solutions.

Understanding that a one-size-fits-all strategy is obsolete, Intellectsoft offers three distinct service models designed for startups, small-to-medium enterprises, and large corporations, respectively. This nuanced approach springs from their recognition that each enterprise varies in its objectives, infrastructure, and financial bandwidth.

Over 13 years, Intellectsoft has consistently demonstrated a confluence of innovation, adaptability, and personalization, forging its reputation as a top-tier banking software entity. Their impressive track record of successful collaborations with illustrious names in the financial sector signifies their capability to architect a full-fledged digital metamorphosis, setting the course for enhanced processes, services, and exponential growth.

Their clientele reads like a who’s who of industry giants, including the likes of London Stock Exchange Group, Investment Evolution, Land Rover, Universal Picture-Radar, Eurostar, Jaguar, Audi, Nestle, Clinique, and many more, further cementing their stature in the domain.

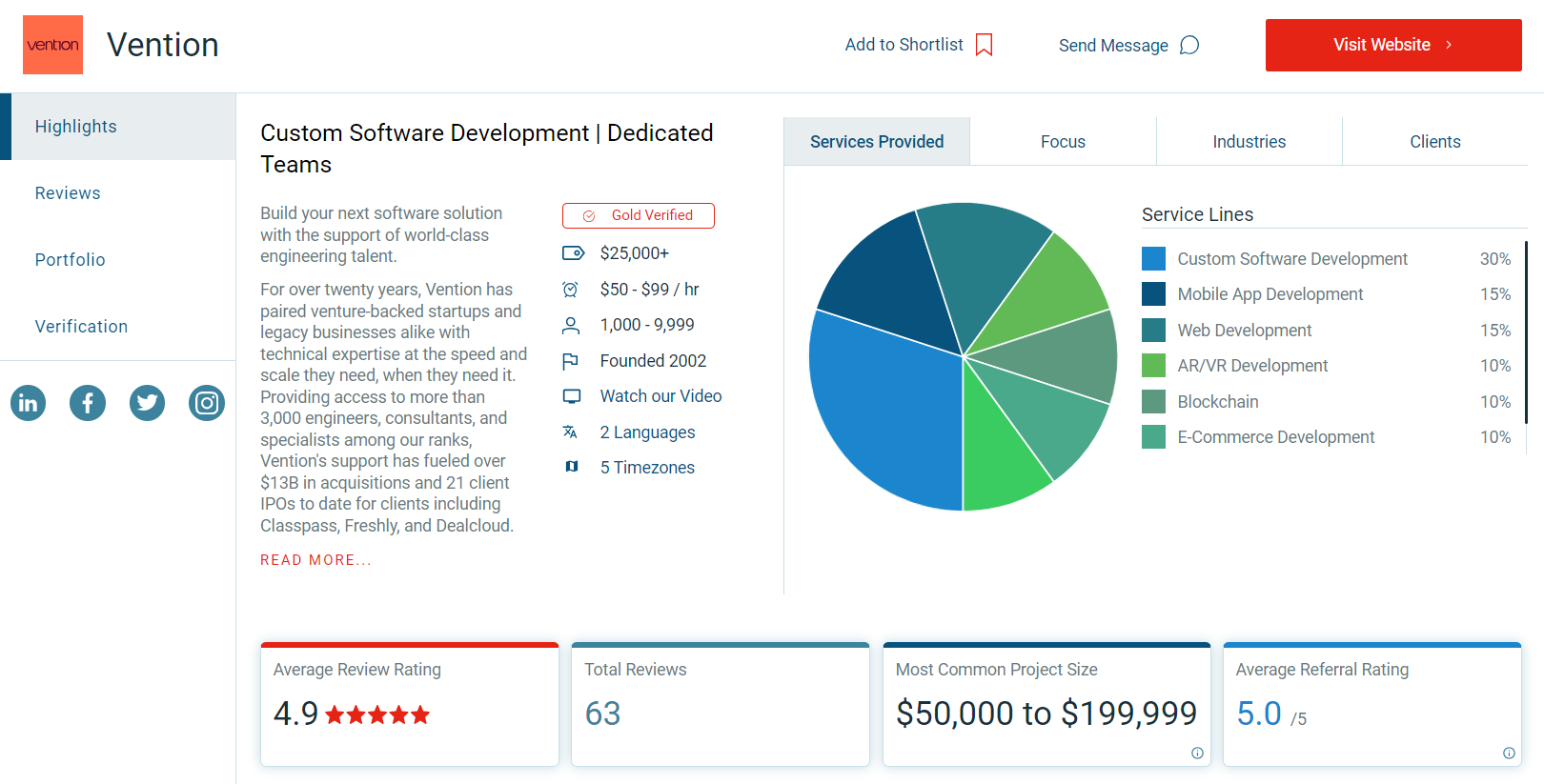

At the confluence of technology and finance, Vention emerges as a masterful software development hub, boasting a formidable battalion of 1,000-5,000 adept engineers and developers. Their mission? To sculpt state-of-the-art software products that empower startups and burgeoning banking and FinTech firms to refine and revolutionize their operational dynamics.

With roots dating back to 2002 and a strategic location in the bustling hub of New York, Vention has consistently been at the zenith of pioneering cloud, mobile, and web application innovations. Their portfolio sparkles with collaborations with some of the industry’s giants, including illustrious names like PayPal, StoneX, EY, PWC, Brex, and Zilch.

Walking side by side with companies through their developmental odyssey, Vention ensures a seamless transition from initial ideation to the unveiling of a product that is poised to make a mark in the financial arena. Their modus operandi revolves around swiftness without compromising on quality, and a relentless focus on creating user-centric applications.

Their unwavering commitment to perfection resonates in the meticulous, reliable, and scalable banking and fintech solutions they craft, harmonizing effortlessly with existing business blueprints. What sets Vention apart is their impeccable adherence to timelines and their emphasis on fostering a collaborative spirit, entwining client inputs throughout the application’s gestation period – from conceptualization, through UI/UX design, assimilating feedback, to the grand finale of product deployment.

For Vention, the size of your establishment is irrelevant. Whether a titan in banking or a budding fintech venture, their aspiration remains unaltered: to forge unparalleled, tailor-made financial software that encapsulates every nuance of your vision, from the embryonic design phase to the final, polished product, ensuring every facet of your process and service is optimized and automated.

An impressive ensemble of collaborations, including Ic Markets, Sungage Financial, Merkle, Doctors Without Borders, Thomas International, Slice, VerseX Studios, Stone X, Vestwell, Integrate, and Verfacto, further accentuates Vention’s prowess in the fintech domain.

Today’s dynamic banking environment sees tech giants entering the sector, alongside numerous fintech startups offering cutting-edge technology for enhanced security and autonomy. Traditional banks face the challenge of improving operational efficiency while retaining customers, leading to the adoption of Robotic Process Automation (RPA), such as AI-driven chatbots, to streamline processes.

The blog post introduces six standout banking software development companies that excel in providing innovative solutions, emphasizing their commitment to delivering top-tier software development at an affordable price point. These companies, including Sprinterra, Chetu, Geniusee, Praxtent, Intellectsoft, and Vention, are described as pioneers in digital banking transformation, offering tailored solutions for modern banking, AI-driven innovations, and expertise in navigating the digital shift in finance. They play crucial roles in helping financial institutions embrace the digital age, ensuring they remain competitive and customer-focused.

Get the latest insights on exponential technologies delivered straight to you

© 2025 Sprinterra. All rights reserved.