Did you know that over 70% of banking customers use banking apps? That’s a lot of people who are relying on their phones to manage their finances. And with so many different banking apps on the market, it can be tough to know which one is right for you.

According to a recent survey, a whopping 90% of people who use banking apps are satisfied with their experience. And that’s not surprising, given all the features and benefits that these apps offer. For example, you can use most banking apps to:

- Check your account balance and transactions

- Set up direct deposits and automatic bill payments

- Transfer money between accounts

- Remote deposit checks

- Monitor your credit score

- Send money to friends and family

- Apply for loans or credit cards

- Chat with customer service

But some apps offer much more than that! The banking industry is undergoing a digital revolution, with many leading financial institutions racing to use the latest technologies, including artificial intelligence (AI) and machine learning (ML), to automate and streamline operations, improve customer service, and reduce costs.

As part of this transformation, banks are upgrading their legacy apps and online presence or developing new solutions to attract more tech-savvy customers and make it easier for not-so-tech-savvy clients to manage their money on the go. As a result, most banking apps have become mobile powerhouses, providing many of the same account services as traditional banks without requiring customers to visit a physical branch and wait in line for a simple transaction.

Here are some of the best banking apps as of April 2023, based on reviews and features:

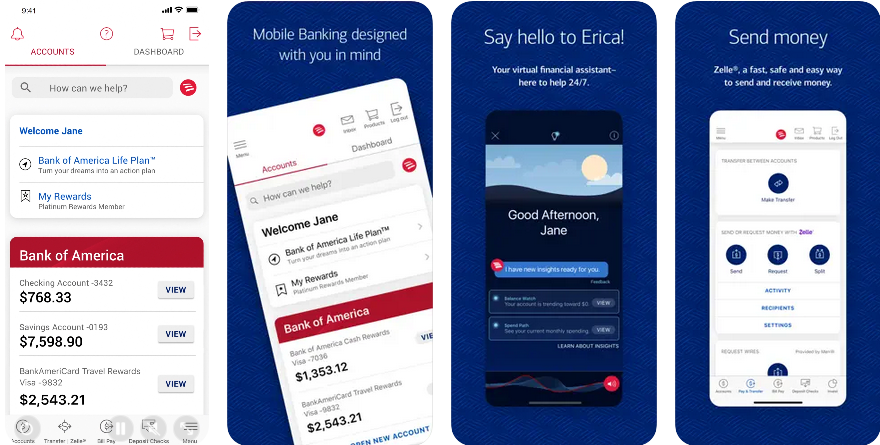

Bank of America Mobile Banking App

iOS app rating: 4.8/5 stars · 4.1M reviews

Android app rating: 4.6/5 stars · 1M votes

Forbes rating: 5/5 stars

Pros: In addition to standard mobile banking features like managing checking, savings, investment, and credit accounts, the Bank of America app has a unique built-in spending tracker and budgeting tool to help customers take control of their finances. It also includes a security meter that shows account security and steps to reduce fraud risk. The app comes with its own virtual assistant named Erica, which can help customers with transactions, bill payments, balance checks, and provide spending insights.

Cons: BofA accounts have lower rates than most banks, most accounts have monthly fees, and there’s no 24/7 customer service.

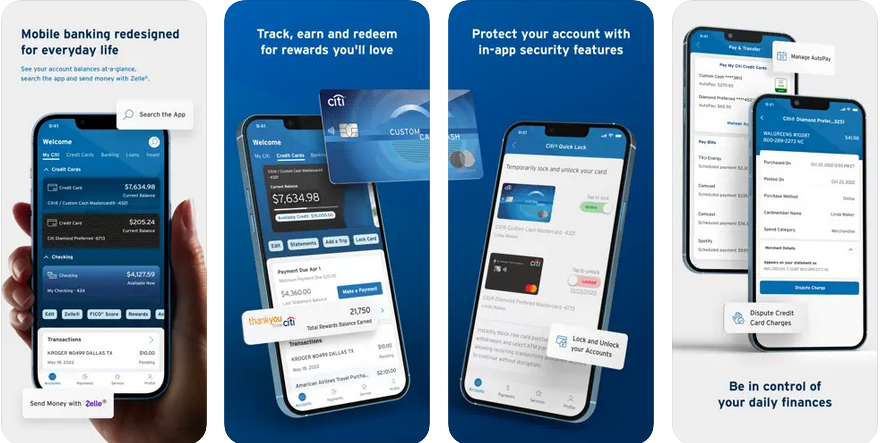

Citi Mobile App

iOS app rating: 4.9/5 stars · 3.4M reviews

Android app rating: 4.6/5 stars · 1M votes

Forbes rating: 5/5 stars

Pros: “The easiest app to navigate”, as claimed by its users. In addition to market-standard features, like managing multiple accounts, balance updates, bills payments and peer-to-peer transactions, Citi Mobile app allows users to track FICO score, set savings goals, and even view a quick summary of customer’s accounts without logging in. Experts add that it is also highly secure, because Citi uses multiple layers of security and alerts to notify users of suspicious activity.

Cons: Citibank has lower rates than most banks, some users have reported bugs with biometric authentication, and there are costly monthly fees if account requirements are not met.

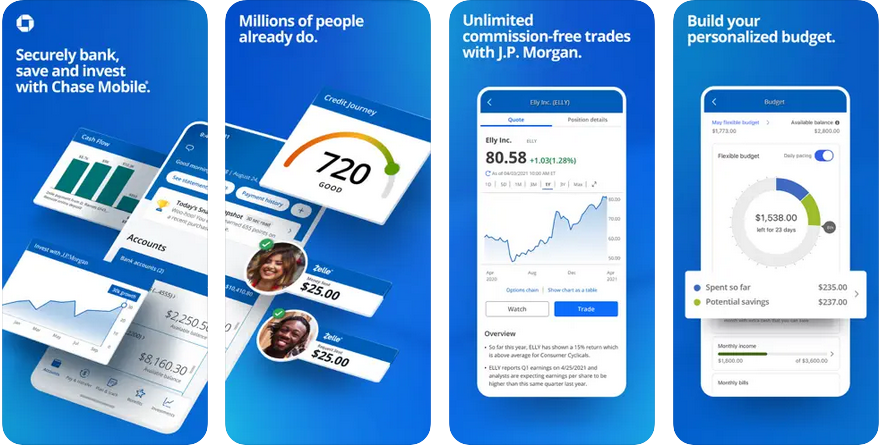

Chase Mobile®: Bank & Invest App

iOS app rating: 4.8/5 stars · 4.8M reviews

Android app rating: 4.4/5 stars · 1.8M votes

Forbes rating: 5/5 stars

Pros: Chase’s mobile app makes it easy to manage all of Chase accounts – private & business, and also both debit and credit cards. The comprehensive 360 degrees overview of the accounts allows users to manage and improve their financial health – all in one place. The app offers a free credit score via its “Credit Journey” tool, while a built-in budget planner makes it easy to identify areas where users can save. There is an option for a facial recognition or fingerprint sign-in for extra security and password-free convenience.

Cons: The app interface can feel cluttered with product advertisements; Chase accounts have lower savings rates than most banks

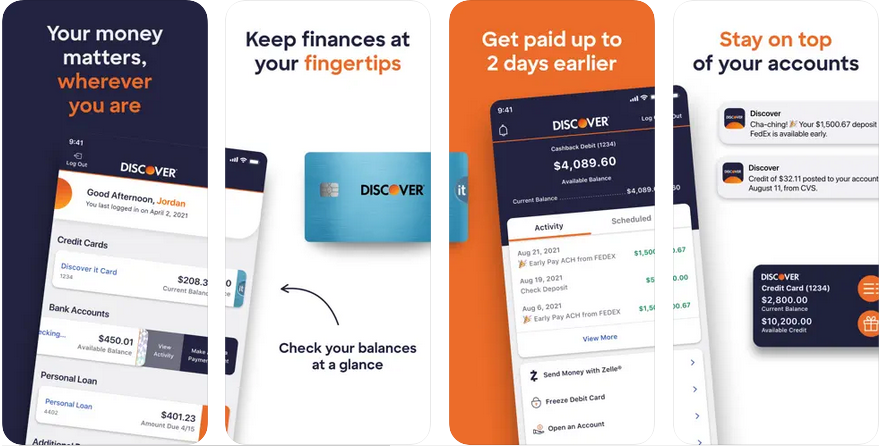

Discover Mobile

iOS app rating: 4.9/5 stars · 4.1M reviews

Android app rating: 4.7/5 stars · 281K votes

Forbes rating: 4.5/5 stars

Pros: Discover’s mobile app makes it easy to access accounts from anywhere. Customers can view and send secure messages, complete Zelle transfers, and handle all banking needs from the app. It’s simple to use and easy to manage finances on the go, make payments, turn cards on or off and manage rewards. Users can also customize a basic “Quick View” that displays their balances without requiring a full login. Discover’s 24/7 support is a valuable differentiator that users give high marks.

Cons: The app lacks customizable budgeting or savings tools, and there’s no support for cash deposits.

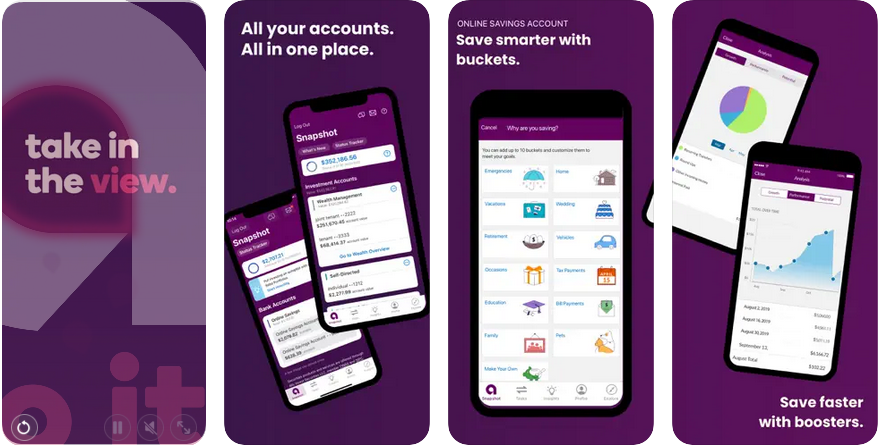

Ally: Banking & Investing App

iOS app rating: 4.7/5 stars · 55K reviews

Android app rating: 3.9/5 stars · 25K votes

Forbes rating: 4.9/5 stars

Pros: Ally was one of the original online-only banks, and still is one of the most popular apps on the market. Users enjoy a full suite of account management options, including account transfers, mobile check deposits, locate ATMs, track investment portfolios and send money with Zelle. Ally apps also lets customers round up debit card purchases to the nearest dollar and have the spare change automatically moved to their savings account.

Cons: Android users have reported investment account limitations, and there’s no support for cash deposits.

How to Improve Your Online Banking Offerings

Legacy bank systems were designed for a very different environment, one where products and channels and volumes were comparatively static. To compete effectively in this market, you’ll almost certainly need a platform that is API-enabled, allowing your institution to rapidly adapt to any new opportunities, whether internal and external. Cloud-based systems now make it far easier to develop and test products, scaling up and down resources quickly as demand rises or falls.

In today’s digital age, a great banking app is the key to customer loyalty and retention. According to a recent study by PwC, over 70% of customers said they would switch banks if their current bank’s app was not up to par.

By investing in a great app, banks can ensure that they are meeting the needs of their customers and keeping them loyal.

A well-designed mobile solution that is easy to use and navigate can lead to increased satisfaction and brand advocacy.

Here are some tips on how you can improve your banking app:

- Make it user-friendly. Ensure that your app is easy to navigate and has clear buttons and features. You can do this by conducting user testing and getting feedback from your customers.

- Make it secure. Implement robust security features like two-factor authentication and encryption to protect your customers’ data.

- Make it feature-rich. Offer a variety of features, including bill pay, mobile check deposit, and peer-to-peer payments to make your app more useful for your customers.

- Make it personalized. Tailor your app to meet the individual needs of your customers by offering different features and settings based on their account type, usage, and preferences.

- Make it engaging. Consider adding gamification or exclusive content to make your app more fun and engaging to use. This could include things like rewards programs, leaderboards, or access to exclusive content.

- Make it reliable. Ensure that your app is always up-to-date and provide 24/7 customer support to resolve any issues that may arise.

As a banking industry leader, it’s essential to improve your app continually to stay ahead of the competition and meet the ever-changing needs of your customers.

Sprinterra is a leading financial services software development company that can help your organization create a custom banking app tailored to your specific requirements. Our experienced developers create user-friendly & secure apps that offer a variety of features to enhance your customer service and reduce costs. Contact us today to start earning more tomorrow!